Contributors:

Molly Murphy CFP®, Tracy Shackelford, Julie Hetland CFP®

If you think about just how far women have come in the last half century, it’s pretty astounding. It was just 50 years or so ago that many women couldn’t dream of pursuing a career they loved. If they worked outside the home, it was assumed they would get paid a fraction of what a male colleague got. And the home front was considered their domain—and responsibility.

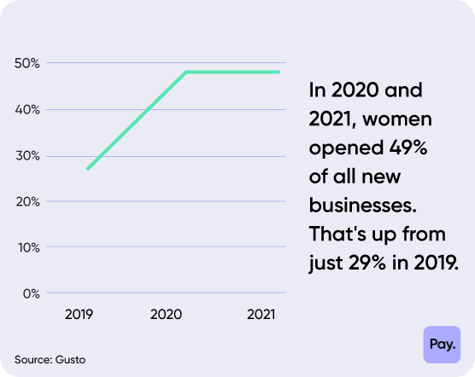

Today, women make up 57.5% of the labor force. They dominate the ranks of college and post-secondary graduates. Women surpassed men in 2019 and now make up 51% of the U.S. college-educated workforce. When it comes to secondary degrees, over half (52%) of Juris Doctor (J.D.) recipients in 2024 are women, compared to 30% in 1980 and half (50%) of Doctor of Medicine (M.D.) recipients are women, compared to 23% in 1980, according to the Pew Research Center. In addition, some 14 million women-owned businesses make up 39.1% of all U.S. businesses – a 13.6% increase from 2019 to 2023, and during that time, added 1.7 million firms, 579.6 billion in revenue, and 1.4 million jobs to the economy, according to the Independent Women’s Forum.

Women now have the independence and resources to make decisions for their financial futures on their own terms. Even with the progress over the last 50 years, there’s still work to do. Women face unique financial challenges. Though they won’t stop you from making progress, you need to pay attention and make sure you’re doing all you can to make them work in your favor.

1. Plan For A Long Life

Lucky you! Women’s life expectancies continue to increase, now clocking in at 79.3 as of 2021. And women who live to at least age 65, can expect at least another 20 years of life. That’s more time to enjoy your family, your career, and your passions. The challenge is that a long life means more years of retirement to plan for, with higher medical bills and special consideration for long-term care.

As you’re preparing for retirement, remember to…

Save early, save often: Saving early is crucial for retirement readiness, despite financial demands. Even small savings can grow significantly over decades. Aim to save at least enough to receive your employer's match.

Be a savvy investor: Over the long run, stocks have proven to have higher returns than fixed income or cash—but they carry more risk. Understand that you’ll have to accept a reasonable amount of risk to grow your savings and outpace inflation.

Dream big: Who says retirement means downsizing and winding down? For some, it’s time to launch an encore career, start a business, volunteer, or travel. Since retirement planning is a marathon and not a sprint, keep these goals in the foreground as you save and invest for the future.

2. Mind The Gap

Despite all the progress that women have made, the pay gap is alive and well. Overall, women earn 80 cents for each dollar a man earns.

The good news is that companies are taking note and implementing policies that help to shrink the pay gap. For the time being, though, it’s still up to individuals to confront and combat pay inequity. Arm yourself with the tools you need to get paid what you’re worth.

Negotiate like a boss: According to a 2024 study by Indeed, more than half of women around the world have never asked for a raise, which has a snowball effect. You won’t get a higher paycheck if you don’t ask—so ask! Research prevailing salaries for your industry and years of experience. Then lay out the business case for the salary you deserve.

Prepare for pushback: Bear in mind that employers judge men and women differently. Asking for a higher salary might get you labeled as “pushy” or “selfish” by employers. That’s why it’s important to strike the right balance between assertive and being a team player.

Bring your A-game: In some cases, it may make sense to work with a career coach to help you learn the most effective techniques for successful negotiations.

3. Rule The Roost

For many American women half a century ago, life followed a predictable path: go to school, meet a partner, settle down, have a family, retire. It doesn’t work that way anymore. Now women are marrying later—or not at all. About half of marriages end in divorce. Women are having children on their own.

Given this reality, the old financial planning playbook needs an update.

Given this reality, the old financial planning playbook needs an update.

Get time on your side: If you choose to stay single throughout your 20s, 30s and beyond, use it to your advantage. You may have a greater ability to focus on your career and create more opportunities to create wealth.

Don’t shy away from hard conversations: Women tend to take more breaks from work to raise a family, and it can negatively impact their lifetime earnings. If you want to avoid that fate, talk to your partner about how you’ll equitably take on childcare duties or pay for care.

Make it a family affair: Long before your parents experience a health crisis and you must make decisions in the heat of the moment, decide as a family what kind of care they want and how it will be paid for. Enlist all siblings so responsibility doesn’t fall to just one person.

Line up long-term care: Given the longevity trends, women will likely face old age alone. How will you get through this time when you are no longer able to care for yourself? Decide whether you’ll buy insurance or set funds aside to self-insure.

4. Win The Confidence Game

Women face numerous financial challenges but tackling them with confidence and determination is crucial. Financial expertise isn't innate for most people; it's developed through learning and practice. Empower yourself to master money management and make informed financial choices.

Read just one thing: If your eyes glaze over and your heart starts beating faster at the mere mention of financial planning, take baby steps. Each week, read one blog post on a financial topic that interests you or watch a short video from a financial guru. As your knowledge grows, so too will your confidence.

Be proactive: If your partner loves spreadsheets and reading financial statements, you might be inclined to take a backseat on the family finances. That’s a mistake. Each partner needs to know what’s going on so they are prepared if they need to take over.

Don’t go it alone: Seek out experienced wealth managers who make education a central feature of their service offerings and will answer all your questions

Conclusion

As we celebrate the remarkable strides women have made in the workforce and beyond, it's clear that the journey towards financial empowerment and independence continues. The evolving landscape of career, education, and entrepreneurship for women underscores the importance of strategic financial planning. With life expectancies on the rise and the unique challenges women face in the realm of finance, the role of expert guidance cannot be overstated. Whether it's navigating the complexities of retirement planning, closing the gender pay gap, or making informed investment decisions, a seasoned financial advisor can provide invaluable insights and personalized strategies.

LPL Approval# 554587

About the Author

Bleakley Financial Group

For close to 40 years, Bleakley Financial Group has been providing customized financial planning and wealth management services to a diverse array of clients across the country. Our team consists of more than 150 financial professionals, from financial advisors and research assistants to client support associates. Bleakley services over $9.97 billion in client brokerage and advisory assets across four different custodial platforms (as of 1.10.25).