The author Fyodor Dostoevsky once wrote that “man only likes to count his troubles; he doesn’t calculate his happiness.” The idea that the glass is always half empty perfectly captures how many investors feel about the economy and financial markets, especially over the past few years. During recessions and bear markets, investors worry that the situation will never improve. When the economy and markets do recover, investors worry that it won't last. In both cases, investors often find it difficult to stick to their long-term financial plans, regardless of the historical record. In today's strong market environment, how can investors stay focused and invested?

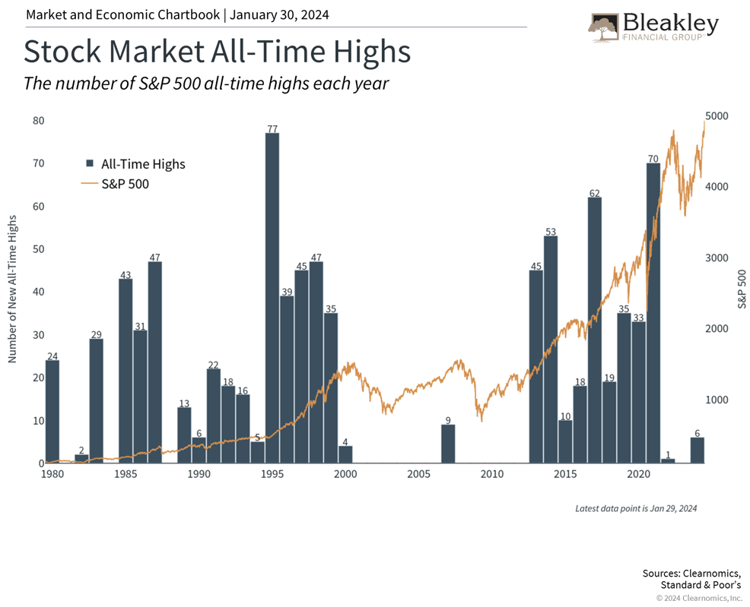

The Market Has Achieved Several New All-Time Highs This Year

The stock market has achieved several new all-time highs this year following last year’s bull market recovery. The S&P 500 and Dow Jones Industrial Average are now 2.0% and 3.6% above their previous peaks from early 2022, respectively. While this is positive for investors, it's natural to also wonder whether markets have run up too far, too fast. After all, it was less than a year ago when many investors and economists were predicting a recession and worrying about the rapid pace of Fed rate hikes. In this context, there are three important facts to keep in mind.

First, it's important to understand that it is not unusual for the market to reach new highs during a bull market. By definition, since markets trend upward over long periods, bull markets spend much of their time at new record highs. The accompanying chart shows how frequently these occur during market cycles. From 2013, when the S&P 500 recovered from the 2008 financial crisis, to 2021, the average year experienced 38 days closing at new all-time highs, or roughly 15% of trading days. Years such as 2017 and 2021 experienced many more. Thus, new all-time highs are not, on their own, reasons to be worried about the market or a signal that the market is about to reverse.

Second, what matters is not the level of the market, but the business cycle and underlying trends. While there is still much uncertainty today due to inflation and the timing and size of Fed rate cuts, market sentiment has improved due to steady economic growth. This has driven rallies in technology-related sectors, including across the so-called Magnificent Seven stocks, as well as in areas such as Industrials, Financials, and Health Care.

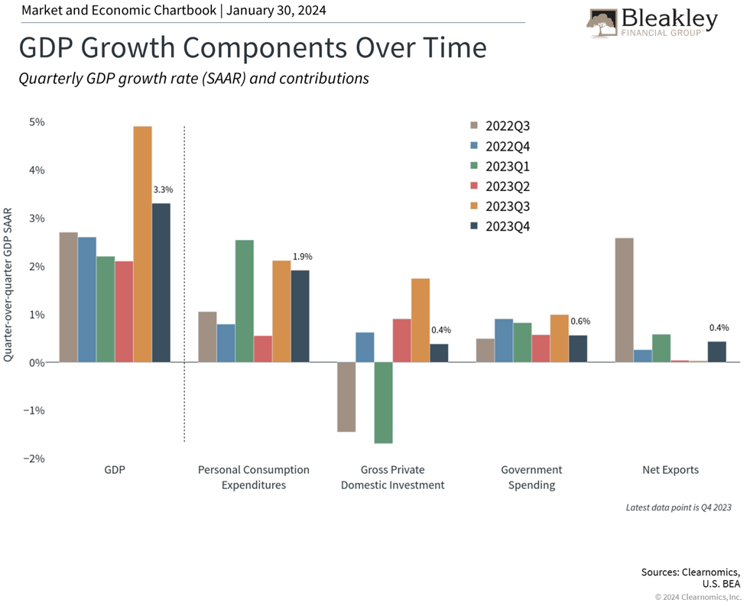

In particular, the latest GDP report for the fourth quarter of 2023 showed that growth was stronger than expected at 3.3% quarter-over-quarter, exceeding economist expectations of only 2.0%. This means that real GDP (adjusted for inflation) grew by 2.5% across all of 2023, one of the fastest growth rates over the past decade. Consumer spending, business investment, government spending, and trade all contributed to these results. In the long run, these factors drive markets more than day-to-day headlines and short-term swings.

The Economy Grew At A Healthy Pace In 2023

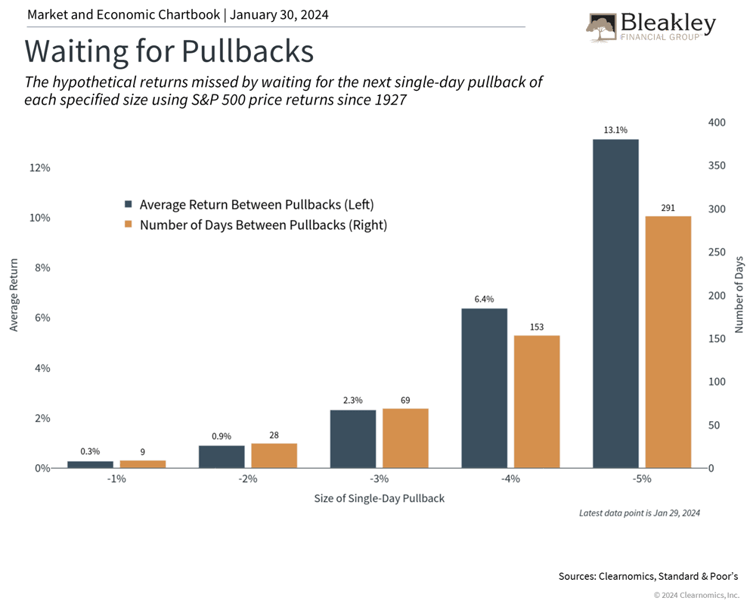

Finally, while it's natural for investors to feel that they should wait for a market pullback before investing new cash or returning to the market, history shows that this can often backfire. The chart below measures the "opportunity cost" of being out of the market and waiting for a better price, compared to simply staying invested.

Waiting for a 3% pullback, for instance, has required being out of the market for 69 days on average across history. Over that period, the market rose much more than 3%, resulting in a missed opportunity of a 2.3% gain. In other words, it would have been better to simply have stayed in the market the whole time. Waiting for a 5% pullback requires 291 days and results in a missed opportunity of 13.1%. Similarly, waiting for 10% market corrections or 20% bear market crashes can take years. In all cases, the confidence that comes from sticking to a plan, rather than trying to time the market perfectly, is an added benefit.

It's Often Better To Stay Invested Than Wait For A Pullback

Unfortunately, doing so requires battling our own tendency to see the glass as half empty when markets are rallying. Of course, none of this is to say that the market only moves up in a straight-line during bull markets. Investors should always be prepared for market swings and unexpected events, as the past few years have demonstrated. However, it does suggest that it's often better to avoid making rash decisions based on news headlines and the level of markets and focus instead on sticking to a well-constructed portfolio, ideally with the guidance of a qualified advisor.

The bottom line? The market has achieved several new all-time highs this year due to steady economic growth. Investors should continue to stay focused and invested and not make decisions based on the level of major market indices alone.

Disclaimer

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. The market and economic data is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. The information in this report has been prepared from data believed to be reliable, but no representation is being made as to its accuracy and completeness.

This commentary is for informational purposes only and is not meant to constitute a recommendation of any particular investment, security, portfolio of securities, transaction or investment strategy. No chart, graph, or other figure provided should be used to determine which securities to buy, sell or hold. No representation is made concerning the appropriateness of any particular investment, security, portfolio of securities, transaction or investment strategy. You should speak with your own financial professional before making any investment decisions.

Past performance is not indicative of future results. Bleakley Financial Group, LLC does not guarantee any specific outcome or profit. These disclosures cannot and do not list every conceivable factor that may affect the results of any investment or investment strategy. Risks will arise, and an investor must be willing and able to accept those risks, including the loss of principal.

Certain statements contained herein are statements of future expectations and other forward looking statements that are based on opinions and assumptions that involve known and unknown risks and uncertainties that would cause actual results, performance or events to differ materially from those expressed or implied in such statements.

The Standard & Poor’s 500 Index is a capitalization weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

The Dow Jones Industrial Average is comprised of 30 stocks that are major factors in their industries and widely held by individuals and institutional investors.

The economic forecasts set forth in this material may not develop as predicted and there can be no guarantee that strategies promoted will be successful. The fast price swings in commodities and currencies will result in significant volatility in an investor’s holdings. International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets. The fast price swings in commodities and currencies will result in significant volatility in an investor’s holdings.

Copyright (c) 2023 Clearnomics, Inc. All rights reserved. The information contained herein has been obtained from sources believed to be reliable, but is not necessarily complete and its accuracy cannot be guaranteed. No representation or warranty, express or implied, is made as to the fairness, accuracy, completeness, or correctness of the information and opinions contained herein. The views and the other information provided are subject to change without notice. All reports posted on or via www.clearnomics.com or any affiliated websites, applications, or services are issued without regard to the specific investment objectives, financial situation, or particular needs of any specific recipient and are not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. Past performance is not necessarily a guide to future results. Company fundamentals and earnings may be mentioned occasionally, but should not be construed as a recommendation to buy, sell, or hold the company's stock. Predictions, forecasts, and estimates for any and all markets should not be construed as recommendations to buy, sell, or hold any security--including mutual funds, futures contracts, and exchange traded funds, or any similar instruments. The text, images, and other materials contained or displayed in this report are proprietary to Clearnomics, Inc. and constitute valuable intellectual property. All unauthorized reproduction or other use of material from Clearnomics, Inc. shall be deemed willful infringement(s) of this copyright and other proprietary and intellectual property rights, including but not limited to, rights of privacy. Clearnomics, Inc. expressly reserves all rights in connection with its intellectual property, including without limitation the right to block the transfer of its products and services and/or to track usage thereof, through electronic tracking technology, and all other lawful means, now known or hereafter devised. Clearnomics, Inc. reserves the right, without further notice, to pursue to the fullest extent allowed by the law any and all criminal and civil remedies for the violation of its rights.

Approval #535191

About the Author

Bleakley Financial Group

For over 35 years, Bleakley Financial Group has been providing customized financial planning and wealth management services to a diverse array of clients across the country. Our team consists of more than 100 financial professionals, from financial advisors and research assistants to client support associates. Bleakley services over $9.4 billion in client brokerage and advisory assets across four different custodial platforms (as of 12.31.23).